A proforma invoice is a type of invoice issued by a seller before providing the actual invoice. It contains all the details of a tax invoice but is not a legal document hence it is not added to the accounting books. A Proforma invoice is a more formal form of a quotation.

A Proforma invoice format in Excel is a template created in Excel with all the required fields to enter the necessary information to create a proforma invoice. Whenever a seller wants to generate a proforma invoice, he can simply use the template, enter the necessary details, take a print and hand it over to the buyer. He can also share it electronically through e-mail or Whatsapp.

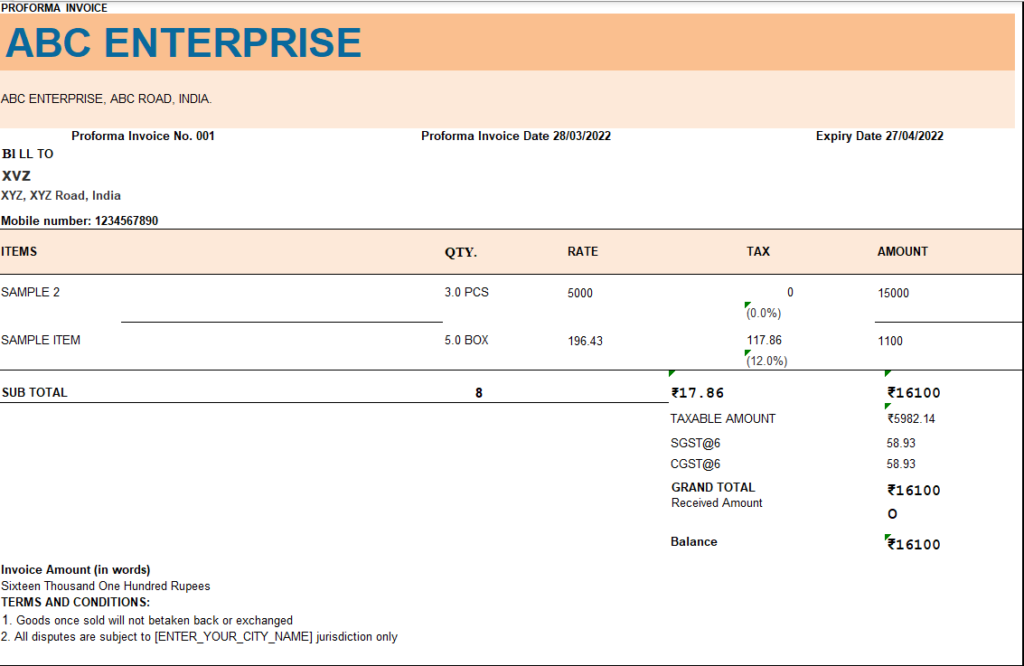

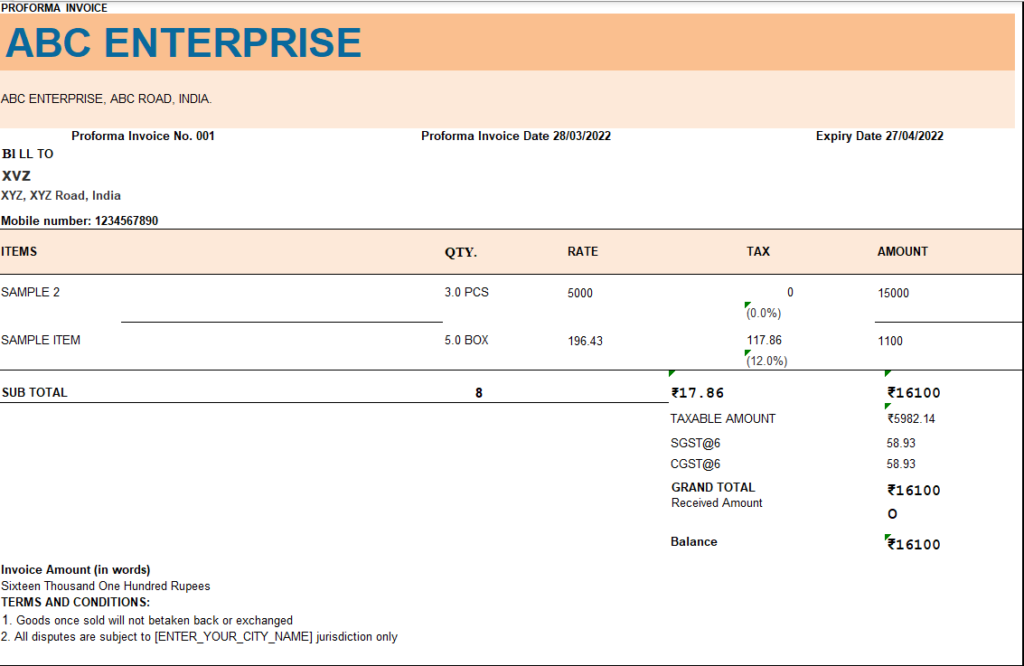

A sample proforma invoice format in Excel is here for free download. You can use this sample invoice directly, make a copy of it and use it whenever necessary. When required, make a copy of the invoice format, fill in the empty fields, save it with a different name and use it either as a print or a soft copy.

The following is a list of the fields to create in a proforma invoice format in Excel:

If you want to create a proforma invoice template in Excel from scratch, you can follow the steps mentioned here. However, you need to have free access to Microsoft Excel sheets to create the format.

Whenever you wish to create a proforma invoice, make a copy of the saved template, enter the details in the empty fields, save it with a different name and use it.

One major disadvantage of using proforma invoices in Excel is that you cannot customise the invoices or use advanced effects. Also, invoice creation takes a lot of time and effort as everything needs to be done manually. Small customisations are possible, but if you require major changes with respect to design and look, it’s a little tough to achieve. Even if you can do it, it requires a lot of hard work.

A better alternative to Excel invoice generation is using billing or invoicing software like myBillBook.

myBillBook is a cloud-based billing and accounting software that helps small and medium businesses generate invoices within a few clicks. Users can simply enter the information in the required fields, and the invoice will be ready in a few seconds. Not just proforma invoices, the billing software, available as desktop and mobile apps, can generate GST invoices, quotations, sales returns, delivery challans, credit notes and the like.

Download myBillBook on your mobile today and enjoy a free trial for 14 days. Experience the app in real-time and if you like it, subscribe to get full access to all its billing and accounting features.

Follow the below-given steps to create an export invoice format in Excel.

myBillBook is a GST billing and accounting software tool that assists in creating polished and professional export invoices easily. Here are some advantages of utilising myBillBook:

Sign up for our free trial offer and explore how myBillBook can streamline your export invoice generation process.