Although the demand for mask-related products is gradually decreasing, demand for medical nonwovens remains relatively high compared to before the outbreak in 2019, according to KNH.

Although many around the world first heard the word “nonwoven” in 2020 at the height of the Coronavirus pandemic, when nonwoven materials like meltblown and spunmelt were in exceptionally high demand due to their protective properties, nonwovens have played a role in the healthcare industry for decades.

Over time, single-use nonwovens have replaced some reusable medical fabrics for applications such as medical gowns, drapes and face masks. One factor driving this shift is that the microbial penetration resistance of single-use medical nonwovens is very high compared to reusables. The prevalence of healthcare-associated infections (HAIs) is also driving growth for medical nonwovens. According to the U.S. Centers for Disease Control and Prevention, about one in 31 hospital patients has at least one healthcare-associated infection on a given day. HAIs can significantly delay recovery, increase the cost of a hospital stay, can result in death in some cases, while also costing healthcare institutions billions of dollars annually.

“Historically hospitals have purchased medical products/personal protective equipment (PPE) based mainly on price,” says Phil Mango, Nonwovens Consultant, Smithers. “Now, due to mainly regulatory changes, they are assessing ‘cost to use,’ which includes not only initial price, but also the cost to treat HAIs which are now more the direct responsibility of the hospital. Higher cost, higher performance nonwoven-based products may be lower cost in use when they reduce HAIs and their cost. A good example is underpads; nonwoven based products are usually more expensive than formed pulp or tissue based underpads, but their performance is much higher, minimizing some labor costs (to change pads) and HAIs (better absorbency and dryness).”

Hartmann, a manufacturer of healthcare and hygiene products, develops a range of nonwoven medical products, including drapes, gowns and masks, as the focus is on offering patient protection. “Given the necessity of protecting against infective pathogens (especially in light of the recent pandemic), as well as against the chemical agents present in the healthcare settings, the role of PPE in HAIs prevention has grown in importance. In addition to product qualification, attention is given to increase process compliance to reduce the risk of HAIs in hospital settings,” says a Hartmann spokesperson.

Since Hartmann is now MDR (Medical Device Regulation)-compliant, it is moving further in offering dual protection—protecting the patient and the healthcare professional. For example, the company’s assortment of gloves is fully qualified to the relevant European standards for medical and protective products. Specifically in the nonwoven category, its FFP2-grade mask, which launched during the coronavirus pandemic, is now part of Hartmann’s mask range. Additionally, Hartmann is actively engaging with the relevant institutions and market players on further expanding the regulatory landscape of protective devices in Europe, according to the spokesperson.

Serkan Gögüs, CEO, of Turkish nonwovens producer Mogul, says that nonwoven materials for medical applications have many advantages both with regard to user requirements and material properties. “They guarantee the safety of patients and medical staff because of their superior levels of infection control, sterility and efficiency,” he explains. “Shorter production cycles, higher flexibility and versatility and lower production costs are some of the reasons for the popularity of nonwoven materials in medical applications.”

In 2020, the coronavirus pandemic led to a surge in demand—and therefore significant investment—in nonwoven materials, especially meltblown. As demand for these materials has normalized, the industry is dealing with an oversupply situation.

According to Mango of Smithers, over the last year, medical nonwovens demand in general has returned to pre-Covid status, with perhaps the exception of face masks, which still appear to suffer from some inventory corrections. “Projections are that face masks will return to pre-Covid level plus about 10% higher. This is due to general population exposure plus availability/price plus growing use for air quality issues globally,” he says.

Meanwhile, supply has not changed much apart from meltblown nonwovens, which are in a serious oversupply position globally, he adds. “Some older lines may close, and there are other meltblown end uses, but oversupply here will most likely last for years.”

Executives from KNH, a Taiwanese nonwovens manufacturer, say that overall, the current market supply is gradually surpassing demand, and manufacturers and brand owners worldwide are actively seeking new application areas and innovative approaches to cope with the situation of excess capacity. At the same time, due to the sustained improvement in people’s hygiene awareness, the demand for various medical nonwovens continues to grow.

Although the demand for mask-related products is gradually decreasing as the pandemic subsides, the demand for medical nonwovens remains relatively high compared to before the outbreak in 2019, according to the company. This phenomenon indicates that consumer demand for hygiene products has become a long-term habit, providing stable demand for the medical nonwovens industry, and driving the industry in a more professional and sustainable direction, executives say.

Manufacturers of both the nonwovens and the final products continue to focus on R&D and innovation to enhance their portfolio of products for the healthcare market.

Owens & Minor is a global manufacturer of PPE products through its HALYARD* brand. The company acquired the Surgical and Infection Prevention business of Halyard Health, a provider of healthcare supplies and solutions that target the prevention of healthcare-associated infections, in 2018.

HALYARD* nonwoven PPE products include surgical gowns, isolation gowns, back table covers, shoe covers, sterilization wrap, drape sheets and surgical masks. These products are primarily manufactured in Lexington, NC, with the HALYARD* brand’s own nonwoven fabrics such as spunbond, meltblown, spunbond-meltblown-spunbond (SMS) and customized laminate composites.

HALYARD* isolation gowns are made with SMS and are used in approximately 3500 U.S. healthcare facilities. In 2021, the brand launched three AAMI Level 2 over-the-head HALYARD* isolation gowns as part of its growing gown program. The over-the-head design provided a new feature that allowed for easy and quick donning. “All three AAMI Level 2 isolation gowns help reduce the risk of contamination and transmission of infectious organisms that can lead to hospital acquired infections,” says Patrick Robert, senior global director, Surgical Solutions and Nonwovens, Owens & Minor.

Owens & Minor also recently launched HALYARD* AERO CHROME* AAMI Level 4 gowns, which provide the highest level of fluid and microbial protection with a unique breathable back panel that maximizes airflow through the surgical gown.

According to Robert, Owens & Minor’s HALYARD* brand is the only U.S. isolation gown provider with vertically integrated raw material production, finished good manufacturing and national product distribution that services hospitals with PPE supplies every day. Over the past five years, Owens & Minor has also made several investments to broaden manufacturing capabilities and better serve its customers. In 2019, the company installed a tri-lamination line to produce composite laminates combining its nonwovens with other substrates, such as films, to make unique structures. In 2021, it expanded warehouse capacity for raw materials and rolls to better ensure supply continuity for its customers.

Earlier this year, Ahlstrom, which offers a range of high-performance medical fabrics that are used in sterile barrier systems, surgical gowns and apparel, drapes, face masks and coveralls, launched Reliance Fusion Sterilization Wrap, a next generation simultaneous sterilization wrap that helps increase efficiency of the Central Sterile Services Department (CSSD), while reducing the likelihood of wet packs.

According to Ilona Weart, head of Product Development, Medical BU, Ahlstrom, Reliance Fusion incorporates the best properties of polypropylene-based and cellulose-based materials. The wraps combine high filtration SMS (spunbond-meltblown-spunbond) with wetlaid technology, bonded together. “This material allows a significant reduction in drying time (33%-40% faster than traditional SMS-SMS wraps), reduces the likelihood of wet packs, and leads to increased efficiency in the sterilization of trays thanks to higher throughput, and savings in energy and labor,” she says.

The Reliance Fusion portfolio consists of two simultaneous sterilization wrap options which can eliminate the need for multiple types of wraps, contributing to the simplification of the sterilization process and greatly reducing the number of products needed in stock. Reliance Fusion Light is for light-to-medium duty applications, and Reliance Fusion Heavy is for heavy duty applications. Both options offer superior pre-vacuum steam drying time performance under high tray weight conditions.

Reliance Fusion is at present offered with limited regional availability. Currently pending 510(k) and not available for sale within the U.S. at this time.

Mogul is also focusing on product development for the healthcare market. The company recently started R&D studies to offer two new products to the medical market. First, a surgical mask fabric with antioxidant, skin conditioning and skin protecting properties is obtained by transferring postbiotics to spunbond fabrics to be used as facial masks as well as medical masks. The other is a multi-functional (anti-odor and anti-bacterial) washable (reusable) mask fabric that is obtained by adding collagen to its Madaline microfilament fabric.

Additionally, as one of the key players in the meltblown market, Mogul has started three new meltblown lines since the start of the pandemic. “Our recent investments in new high efficiency meltblown lines, which have been made to target high efficiency masks materials, will strength our position in the medical business,” says Gögüs.

For the healthcare market, KNH produces soft and breathable thermal bond nonwovens, as well as meltblown nonwoven materials with high filtration efficiency and breathability. These materials are widely used in various medical products, including masks, isolation gowns, medical dressings and disposable medical care products.

Recently, KNH has further developed lightweight and breathable medical dressing materials and elastic bandage products, expanding the applications of the new generation of nonwoven materials in medical use through research and innovation. According to the company’s International Hygiene Operations Business Unit, lightweight and breathable medical dressing materials exhibit excellent absorption performance and good breathability, offering a comfortable user experience while effectively preventing infections and protecting wounds. This further meets the demands of healthcare professionals for functionality and efficacy.

Additionally, KNH is dedicated to developing sustainable and environmentally friendly nonwoven materials while minimizing adverse impacts on the environment. In the development of nonwoven materials for medical use, KNH combines modification and development technologies for high polymers and fiber materials, as well as advancements in production processes. This enables KNH to develop functional nonwoven materials that exhibit higher biodegradability or recyclability in future products, thereby reducing the environmental impact of waste.

In India, Manjushree Spntek is a new producer of high-performance nonwoven solutions that began production in early 2023. The company is the flagship business venture of the Manjushree Group which has varied interests in the health, wellness, packaging and financial services sector.

“The group has a firm belief that health and wellness are the new sunrise sectors and hence wanted to pursue a business expansion in this area,” says Rajat Kumar Kedia, CEO and managing director, Manjushree Spntek. “On the other hand, our extensive know-how in polymer processing and decades of collaboration with technology leaders like Reifenhäuser-Reicofil led us to believe in the evolving spunmelt nonwoven technology. The rest of it just seemed to come naturally to us. The vision of the future combined with deep expertise and experience led to the formation of Manjushree Spntek.”

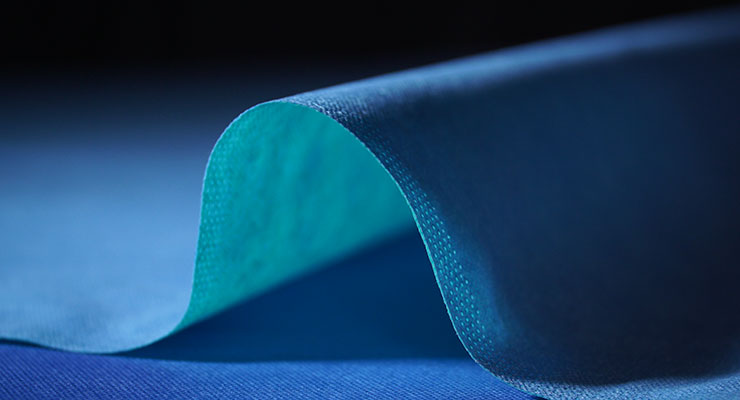

The company’s products serve the medical sector by providing performance fabrics for infection control apparel and PPEs. These fabrics are also used to make surgical gowns & drapes, masks, under pads and sterile wraps. In hospitals, the infection control apparel protects patients and frontline medical staff from deadly bacteria and pathogens, while performing surgeries or in critical wards. The products meet all the requirements of AAMI - Association for the Advancement of Medical Instrumentation – Levels 1, 2 and 3.

Manjushree’s products are also being used by the personal hygiene industry to make baby and adult diapers and sanitary pads. The finer filaments from its latest Reicofil Smart line makes the product softer, more absorbent and have a velvet cloth like, tactile feel.

Manjushree Spntek’s investment in a treatment line provides massive benefits for manufacturing high end alcohol repellent / anti-static (AR/AS) coated fabrics with AR6-AR9 chemistry and also produce fabrics embedded with therapeutic minerals, vitamins and other botanical extracts which helps in curing wounds and other skin related issues. The company is also pursuing R&D projects for its customers.

Kedia says that surgical gowns and drapes made from the untreated base web - PP SMMS multi-layer composite fabrics - are not resistant to blood pathogens, owing to low surface tension and are prone to develop static charge build up. Build-up of static charge on surgical gowns and drapes in modern operation theaters poses a risk of fire in the operating room, he explains. Thus, the high barrier, alcohol repellent and anti-static treated (AR-AS treated) PP SMMS fabrics provide the much needed protection to the doctors, staff and the patients in times of critical need.

“Every part of our body, from our skin to our muscles to our nerves, requires minerals to function properly,” says Pranay Sahu, CSMO, Manjushree Spntek, and patent holder for nonwovens comprising therapeutic minerals. “The regeneration of healthy and functional skin remains a huge challenge due to its multilayer structure and the presence of different cell types within the extracellular matrix in an organized way. Despite recent advances in skincare and wound care products, traditional therapies based on natural and organic materials such as plant extracts, minerals and honey are interesting alternatives.”

According to Sahu, natural compounds have been used in skin care for many years due to their anti-inflammatory, antimicrobial and cell-stimulating properties. “These therapies offer new possibilities for the treatment of skin diseases, enhancing access to healthcare, and allowing to overcome some limitations associated with modern products and therapies, such as the high costs, longer manufacturing times and the increase in bacterial resistance,” he adds.

Manjushree Spntek’s nonwovens can be customized not only for medical disposables products or hygiene products but also cosmetic face masks, bandages, medical gauze, dry and wet wipes for personal care, home and industrial applications.

“Manjushree Spntek is one of the few global nonwoven companies to have put up a state-of-the-art infrastructure and factory using proven technology from Reicofil and A.Celli, to produce high performance functional fabrics. We are always working with our customers to keep them in the lead with respect to product innovations and for the safety of doctors, nurses and patients.” Kedia concludes.

For its part, Freudenberg Performance Materials has launched several new solutions in the woundcare category. This includes the recently introduced elastic variant of its flexible superabsorbers for modern wound dressings. These superabsorbers increase the comfort level for patients as well as enabling longer wear time, thus reducing the frequency of dressing changes.

According to Frank Heislitz, CEO, Freudenberg Performance Materials (FPM), the company uses a new technology to manufacture the elastic superabsorbers. Unlike other methods, this technology does not perforate or slit the material, thus achieving a high degree of consistent elasticity. Furthermore, the technology used by Freudenberg bonds the superabsorbent fibers more uniformly with the material, thus enhancing the integrity of this layer in the wound dressing.

FPM healthcare is also focused on developing sustainable materials and solutions for the medical industry. Its new M 1714 wound pad component is a sustainable solution that simultaneously delivers on performance. The dressing consists of bio-based fibers and exhibits a smooth wound contact layer. M 1714 has been evaluated for industrial compostability and conforms to ISO 13432. This enables certification of product biodegradability.

Freudenberg also recently developed an innovative dual-silicone bordered wound dressing. Unlike other dressings on the market, this variant features an extra-strong silicone gel border as outer layer and a patented silicone coating absorbing foam for wound contact. “This combination makes the dressing and very efficient,” says Heislitz. “While the border enables longer wear time and thus reduce cost, the silicone coated foam has only minimal adherence to sensitive newly built skin that forms at the wound edges and thus supports healing.”

Looking ahead, Smithers predicts, globally, the medical market will most likely be one of the slower nonwoven markets over the next few years (~5% compound annual growth rate through 2028). Some of this slower growth is due to continuing corrections from higher growth due to Covid.

“In Europe and North America, this is because of several reasons,” Mango says. “One, this market is mature in these regions. Drapes and gowns are the largest medical market sub-segment for nonwovens and in these regions, conversion from textiles is high. Also, sale of adult incontinence products directly to consumers is usually counted as a ‘hygiene’ market; only sales to institutions are counted as ‘medical.’ Finally, high medical costs in these regions encourages non-hospital and/or shorter stay procedures, requiring less nonwoven products.”

Mango expects emerging market regions to do better, as they are projected to grow at higher rates than North America, although China’s recent economic woes may defer this growth somewhat. Longer term, he anticipates Asia and MEA to grow at one and a half to two times North American rates.

Meanwhile, with the increasing of air pollution all over the world, Mogul expects that business volume for filtration and face masks particularly will be increased within the upcoming period. “In this regard, people who are living in developed countries will be willing to use face masks more than ever due to health concerns,” Gögüs says. “Medical industries in these regions such as America, Canada, Far Asia (China and Japan) and EU countries will grow in the coming years.”

Ahlstrom also expects growth in the use of single-use medical nonwovens, which Weart says will be primarily driven by megatrends including an aging population, global population increase and greater accessibility to healthcare in developing regions.

KNH also indicates aging global populations as a driver of demand for medical products and services. Particularly, nonwovens will see more growth opportunities in areas such as hygiene products, surgical supplies and wound care products, the company says. Furthermore, with the improvement of healthcare quality and the increase in average life expectancy, the healthcare industry is becoming more consumer-oriented. “Health-conscious consumers” will play a significant role in driving the widespread adoption of health technology, leading to a continued rise in demand for disposable medical care products, such as adult wet wipes, light incontinence pads, adult diapers and absorbent pads.

In terms of expanding into emerging markets, particularly in Asia and Latin America, KNH executives say the demand for healthcare is steadily increasing due to population growth and economic development. These regions will be important growth areas for medical nonwoven-related products.